Session on GST at iLEAD

Event Date:

August 27, 2017

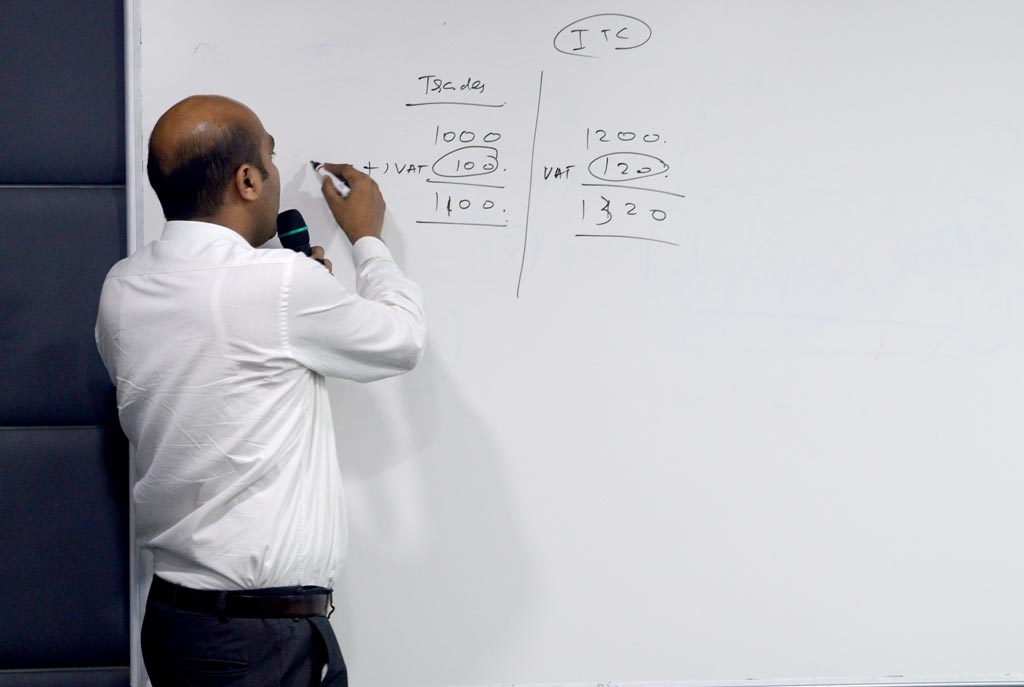

iLEAD organized a session on the current phase of indirect taxation which is Goods and Services Tax or GST. This was a one hour session where the concept was to give a basic idea of this new mode of indirect taxation. The session was conducted by well known taxation expert Mr. Niraj Harodia.

GST was introduced by Central Government in July 2017. It was introduced to make 'one nation one tax scheme' come to action in Indian economy, especially in the Public finance domain and increasing the government revenue is one of the major reasons of imposing this tax. The money coming in this regard will be implemented in various socio-economic development schemes of the nation.

The scheme consolidated 17 taxes into 2 taxes which are Central Goods and Service Tax, CGST and State Goods and Services Tax, SGST. This tax scheme has however failed to reduce burden on many goods and services because of the diversity of transactions in the Indian economy. This scheme has been taken from several developed countries of the world having single indirect taxation structure.

More Goals of GST

* To stop long parallel or non transparent economies running in the country

* Uniformity of Cost of Products in different locations.

* Cascading - a tax on tax where assembling and transport of commodities and services generates new taxes, this format of tax is actually destination based consumption tax.

After an interaction session with the students Dr Kunal Sil - Faculty of Management studies felicitated Mr. Barodia. The enlightening interactive session on GST created awareness about the latest economic changes in the country.